Prior to establishing an enterprise, it is essential to assess and choose the most appropriate kind of an undertaking in terms of law and economics. This choice will affect not solely the quantity of necessary equity capital, but also the legal status of the enterprise and other business related issues.

Foreigners may carry out business in Latvia in the form of a limited liability company (SIA), a stock company (AS) or a European company (SE). It is also possible to be Self-employed person.

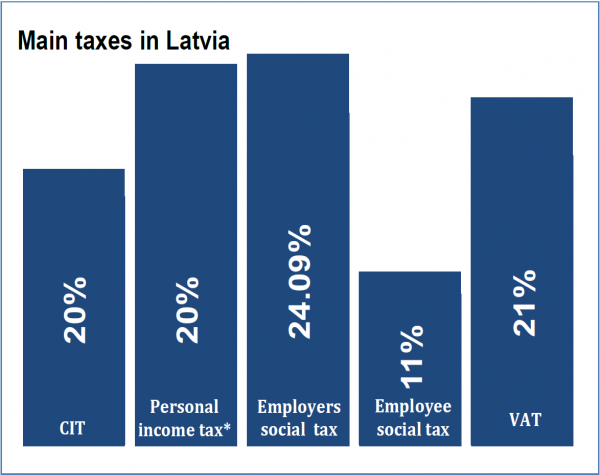

Benefits from the new corporate income tax in Latvia:

- 0% corporate income tax if profits aren’t distributed

- 0% tax for distribution of non- taxable profit

- No audit requirement (if below threshold)

- Corporate directors are possible

- No residency requirements for the directors

- Liberal business laws, AML regulations in European standard

- Authorities focus on formalistic view, which makes activities predictable

- Expiration time for tax: three years

Limited Liability Company (LLC/SIA)

The immense majority of Latvian businesses are launched as SIAs. Foreigners who consider doing business in Latvia also frequently prefer this form of entrepreneurial activity. There aren’t any restrictions on the ownership of Latvian companies by foreigners.

When establishing a SIA, the minimum equity capital is EUR 2820. The equity capital contribution can take the form of both property contribution and cash.

In parallel to the SIA, there is also micro-capital SIA permitted with the decreased requirement for the share capital, starting from EUR 1.

Such Company may be incorporated provided that all the following criteria are met:

- All shareholders are natural persons and the number thereof does not exceed five (may be non-residents);

- Only the founders of the company can be appointed as Board members;

- No shareholder is allowed to be a member of any other company with reduced equity capital.

The process of company registration and formation is not considered complex. The registration only takes a few business days once all incorporation documents are drafted and submitted to the Commercial Registry of the Republic of Latvia. Upon request the registration time might be reduced by up to two business days.

Joint-Stock Company (JSC/AS)

Joint Stock Company similarly as SIA is considered a legal entity. The company is liable for its obligations to the extent of its entire property.

The main difference between a joint stock company and a SIA is that the shares of a joint stock Company may be exchanged freely and traded on stock markets after the IPO procedure. There are different kinds of shares, granting different rights to the operation of business, the payment of dividends and the amount of liquidation quota.

The main criteria for establishment of a JSC:

- any amount of founders, no national criteria;

- share capital at least EUR 35.000,00;

- share capital can be paid up either by financial means or investment in kind;

- the Board of Directors shall consist of at least one member. If the stock of the JSC is publicly traded – at least 3 members.

European Company (SE)

Being a legal entity, such form of business allows changing the jurisdiction within the boundaries of the European Union without suspending the Company’s operations, dissolving the Company or incorporating a new enterprise. Apart from the EU Member States, an SE can also be relocated to Iceland, Norway or Liechtenstein.

Incorporation of a European Company may be achieved through reorganization into a joint stock company.

The minimum equity capital of a Societas Europaea is 120 000 EUR.

Self-employed person

Entrepreneurs may also opt to do business in Latvia as natural persons with liability for their business. These are the individual merchants and the self-employed individuals. These business forms benefit from the lightest reporting requirements and do not need to be registered unless their annual turnover exceeds a certain amount.

This option is suitable for natural persons willing to carry out individual commercial activities in small amounts within the territory of Latvia. If the yearly turnover exceeds 284 600 EUR or in case the turnover exceeds 28 500 EUR and the company has 5 or more employees, the person must register him/herself as an individual merchant.

Please feel free to contact our experts for more information on companies in Latvia.